Authored by Lucas Pratt, Sales | Auctioneer at Pulse

This blog will address the big question on everyone’s mind… When is the right time to buy? Should I commit to purchasing now or hold on to see if the market decreases further?

While an uncertain market can create caution amongst many, the savvy buyer will know their reason for purchasing and look for the opportunities that an easing market presents.

To alleviate the unknowns of the market as it stands (and help you answer the big question), I will touch on current market conditions, reflect on past trends, highlight existing opportunities, and cover important considerations.

Decisions, decisions

While property prices could ease, an important consideration is that as interest rates increase along with inflation, purchasers borrowing power decreases. What this means is that the home that is currently within reach, could become unreachable within a matter of months.

Regardless of market conditions, when you buy is far less important than purchasing the right property for you, based on your current and future needs. What every buyer should keep in mind for a successful purchase, is that property is a long-term investment.

Establishing your reason for purchasing is the single most important decision, which will determine your strategy, and strategy is essential in supporting a long-term investment. You can find out your why by asking yourself one simple question:

Am I buying for lifestyle or financial reasons or a combination?

This will help you to determine the type of property and level of investment you make, based on your current and future requirements.

Determine your why

Purchasing for lifestyle?

You will want to consider a property that can accommodate not only your current stage of life, but one that will meet your needs for the foreseeable future. With lifestyle a top priority, it’s all about location, desired features, and future requirements (room to grow).

Investing in property for financial reasons?

Then it is even more important to thoroughly research the area in which you wish to purchase in, seeking expert advice on current and past market conditions. This will help you to estimate the potential for future growth (such as any proposed investment into the area) and gain an understanding of the price point – which can vary greatly per suburb.

Another financial consideration is a property with the potential to renovate, redevelop or refurbish, as improvements or additions can add immediate value to your property.

If a combination of both is important to you, it is likely you will need to be willing to compromise. Mainly on the type of property you invest in. This type of investment requires foresight on two fronts: predicting market conditions and imagining the potential for a property.

Opportunities right now

Right now, there is a fantastic opportunity for anyone looking to upsize, as easing prices have made it more attainable to upgrade to a larger home. For instance, you may sell your property for 10% less than you would have done 9 months ago, but you will also be saving 10% on a larger investment. Upgraders will also benefit from reductions to stamp duty and other associated fees.

To give you an idea on potential savings, upgrading from a $700k property to a $1.2m property, you could save as much as $60k, after stamp duty and fees.

And, with less investors in the market, buyers have less competition and more time to make educated and stronger decisions. All things considered, my top recommendation is to remember your “why”, so you are prepared to act on the right property and capitalise on this opportunity.

Mistakes to avoid

Common mistakes I have seen time and time again in easing markets are purchasers failing to place a serious offer or delaying a decision, putting them at high risk of missing out. Everybody likes a deal, but it is important to be reasonable. This way, both parties walk away satisfied.

Purchasing a property is the largest investment most people will ever make, and often an emotionally driven decision. If you find something that is right for you, I would say not to over think it. Keep in mind that it all comes down to what you want from a property beyond when to buy.

Another mistake I have seen repeated over the years is people holding off buying in the hope they can predict the market bottoming out and before they know it, prices suddenly rise and what was once affordable suddenly becomes out of reach. Realistically, the only way anyone knows when the market has bottomed out is months after the fact, when prices have already started to creep up once again.

“Opportunities come around once in a property cycle, but no one truly knows how long they will last. I cannot say this enough, the why is much more important than the when.”

Remember… property is a long-term investment. The market has always and will continue to rise and fall, before rising again. If you adopt this mindset, you set realistic expectations for a timely return on your investment and avoid short term disappointment.

Property cycles

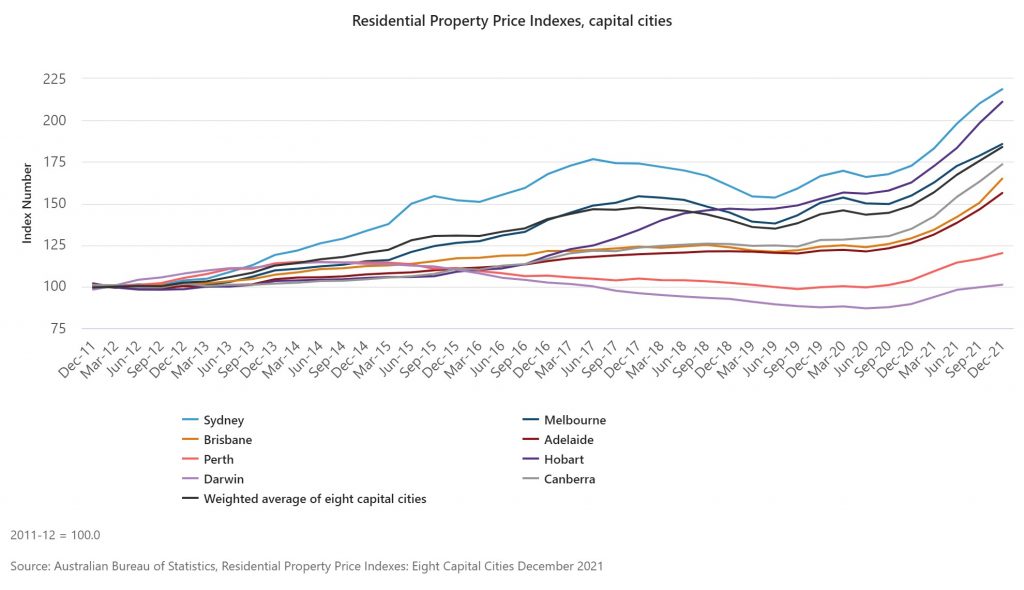

One key takeaway from property prices over the past 50 years (and approx. 5-6 cycles of property), is that prices ebb and flow over time, starting with rising property prices, followed by easing of prices, a plateau or drop in prices before they start to rise again. Depending on various economic factors, this cycle reoccurs every 7 – 10 years – with lesser ups and downs in between. The following is a snapshot of the past decade.

Summary

Whether you fall into the lifestyle or financial category, it goes without saying that it is important to do your due diligence and market research before moving areas. Talking to a seasoned, local estate agent is a great way to gain insight on your area and the local market as it stands.

In summary, know your why, establish your reason for purchasing, and remember, property is a long-term investment. Historical data demonstrates that those who play the long game will see their investment grow.

On a leaving note, some great advice from Elon Musk on investing during times of high inflation.

“It is generally better to own physical things like a home or stock in companies you think make good products, than dollars when inflation is high,” – Elon Musk.

Source: Twitter.